TAX CONSULTANCY

Corporate fiscal matters

Personal fiscal matters

Inheritance and donations

Foreign income

Employee secondment

Real estate and tax optimization

COMPANY INCORPORATION AND TRANSFORMATION

Partnerships and companies

Foreign affiliates

Owner’s income optimizing

Securing private property

Ownership succession

Sale of a business or organized part of a business

ACCOUNTING AND PAYROLL SERVICES

Foreign employer representation

Full accounting reporting

Clearing backlog of accounting settlements

Correction and completion of financial statements

Foreign affiliate accountancy

Accounting for taxes for previous periods

LEGAL ASSISTANCE

Economic law

Labour law

Cooperation with lawyers of various specialities

Comprehensive legal and tax solutions

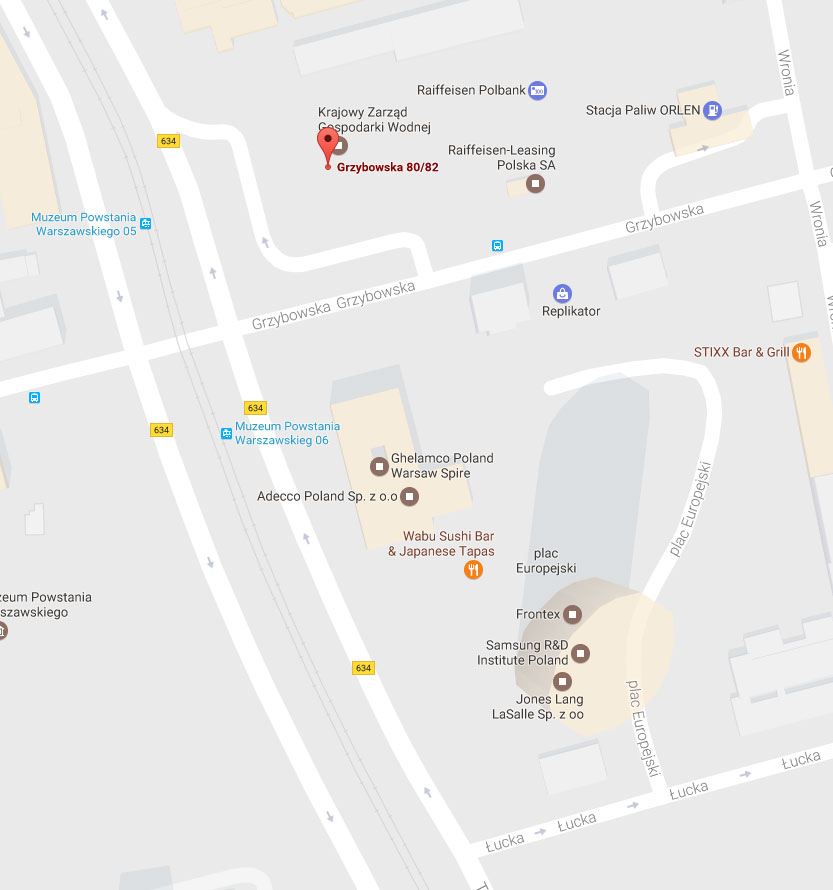

OKW – Olczak – Klimek van der Kroft Węgiełek Kancelaria Radców Prawnych

Common project running